Successfully investing in real estate — whether you are in Boston or anywhere else in the world — is all about correctly timing the market. Knowing when to enter into the real estate market can often be a bit of a challenge. If you are looking at investing in the Boston real estate as a potential investment opportunity, you must read till the end. Boston is a thriving city, which makes it a best location to buy an investment property at any point in time including the present.

Boston is home to around 700,000 people, making the Boston housing market rather large on its own. Since it contains around 80% of all residents of Massachusetts, it is certainly the first place that people choose to research, when they want to invest in the state. The broader Boston metropolitan area is home to more than four million people. Boston real estate has been one of the best long term real estate investments in the nation.

The Boston real estate market is dominated by rental properties and Airbnb is a great pick for starters. The city is a wonderful place to call home. People want to live in the city, yet the number of new homes being built is relatively low. Boston real estate market is a vibrant market, and plenty of buyers are offering more than the asking price when they love a property. Throughout the Greater area of Boston, there are numerous investment properties waiting to be revitalized by a wise investor.

But for most people Boston is a high-priced real estate market, though it isn’t as expensive as Washington DC, San Francisco or New York City. Greater Boston is still an expensive place to buy a house, but the years of relentless price increase may be nearing an end. It’s too soon to know if this trend is a blip or is the Boston housing market heading towards some stability. However, the new investors should always consider cheaper markets for investment.

Because of the large number of students, college and university faculty, it is a no brainer for savvy investors to invest in a rental property in Boston. A rental property in Boston is guaranteed to get a lot of demand from tenants – whether an apartment or a condo or a single family home. In fact, any investment property is likely to get rented out fast. Airbnb rentals are one of the best options for real estate investment in Boston. There are a number of reasons to consider investing in the Boston real estate.

Is Boston going to be one of the hottest real estate markets for investors in 2020? Boston real estate appreciation rate in the latest quarter was around 1.12%. However, it is quite unclear whether it would remain steady or not. Looking at the positive forecast, the annual appreciation rate is predicted to be between 4% to 5%. You can either choose to invest in your future, or market your home to potential buyers. Let’s find out more about it. Please note that there are many variables that can potentially impact the value of a home in Boston (or any other market) and some of these variables are impossible to predict in advance.

Table of Contents

- Boston Real Estate Market Forecast 2020

- Boston Hosuing Market Trends

- Boston, MA Foreclosures And Bank Owned Homes Statistics 2020

- Is Boston a Good Place For Real Estate Investment?

- Investing in Boston Real Estate or Not: The Conclusion

- Other Good Markets To Invest in Real Estate in 2020

Boston Real Estate Market Forecast 2020

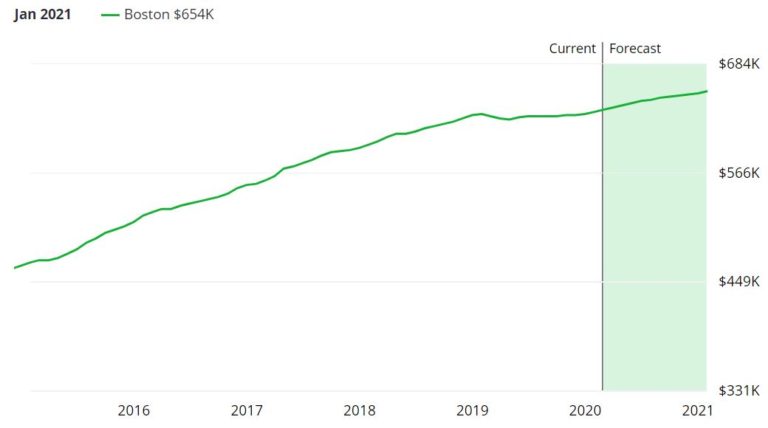

What are the Boston real estate market predictions for 2020? Let us look at the price trends recorded by Zillow over the past few years. Since 2015, the median home price in Boston have appreciated by roughly 34.5% from $470,000 to $631,997. In the past year, the Boston real estate market cooled off, prices rose by only 0.3%. The latest Boston real estate market forecast is that it will bounce back and home prices will increase by 3.6% in the next twelve months.

The latest real estate data from Zillow shows that the current median home value in Boston is $631,997. Boston is currently a buyer’s real estate market – which refers to a situation in which supply exceeds demand, giving purchasers an advantage over sellers in price negotiation.

Here is the Boston, MA real estate price appreciation graph by Zillow. It shows us the current home price appreciation forecast of 3.6% till Jan 2021.

Graph Credits: Zillow

The median list price per square foot in Boston is $758, which is higher than the Boston-Cambridge-Newton Metro average of $307. Zillow reports that 8.1% of the listings in Boston had a price cut in Jan 2020, which is a good thing for buyers. The median price of current listings in Boston is $769,000 and the median price of homes that have been sold is $627,900. The median rent price in Boston is $2,950, which is higher than the Boston-Cambridge-Newton Metro median of $2,650.

Boston Housing Market Forecast 2019 – 2021

The Boston housing market forecast for the 3 years ending with the 3rd Quarter of 2021 is also positive. The accuracy of the Boston housing market trend prediction is 78%. Accordingly, LittleBigHomes.com estimates that the probability for rising home prices in Boston, MA is 78% during this period. If this Housing Market Forecast is correct, home values will be higher in the 3rd Quarter of 2021 than they were in the 3rd Quarter of 2018.

Check this page each quarter for updates to the Boston Housing market Forecast.

Boston Hosuing Market Trends

We shall now discuss some of the most recent housing trends in the Boston area and compare it with past couple of years. We shall mainly discuss about median home prices, inventory, economy, growth and neighborhoods, which will help you understand the way the local real estate market moves in this region. Boston has been one of the hottest real estate markets in the nation for many years. Currently the Boston housing market is relatively friendly to both buyers and sellers.

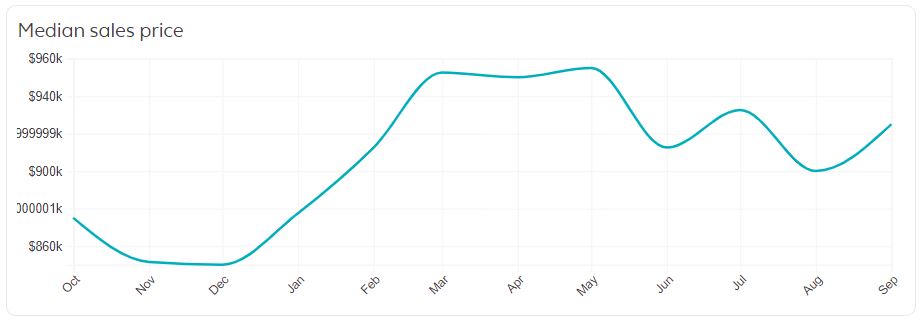

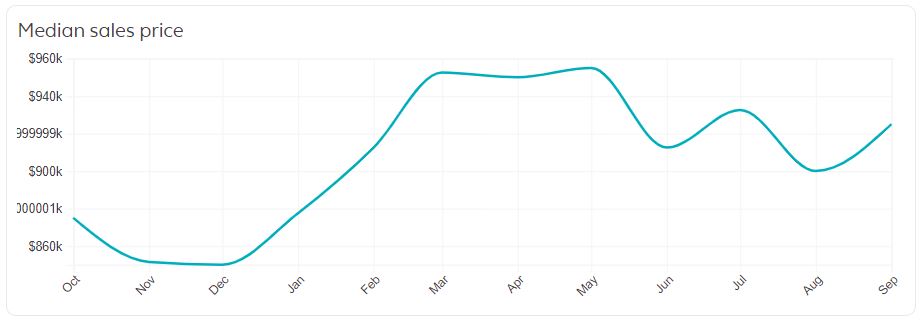

Trulia has currently 946 resale and new homes for sale in Boston, MA, including open houses, and homes in the pre-foreclosure, auction, or bank-owned stages of the foreclosure process. The median price of sold homes in the Boston housing market is $925,000 and homes are selling for about $1076/sqft.

Graph Credits: Trulia

Following the housing market decline in 2007, single family rental properties became favorable options for investors, saving in construction or refurbishment prices. The quick turnaround for an owner to rent out their property means cash flow is almost immediate. Single family rental homes have grown up to 30% within the last three years. Almost all the housing demand in the US in recent years has been filled by single family rental units. With 2020 being, theoretically, in the middle of a boom, there’s still 4 years for residential construction to surge. Most likely, a housing shortage will remain in 2020, keeping home prices high.

The number of single family homes and condos sold in the Greater Boston region in March 2019 was essentially flat, according to data from the Greater Boston Association of Realtors. Boston home prices climbed in the first quarter of 2019, but not at the torrid pace of the last two years. According to GBAR, 1,316 Boston single family detached homes were sold in May 2019. It was a record high single family home sales amid steady price appreciation and rising active listings of homes for sale in Greater Boston in May.

Sales of single-family detached homes in Boston experienced an 8.0 percent increase in year-over-year sales in May 2019, as 1,316 homes were sold compared to 1,218 homes sold in May 2018. The median sales price also reached a record high for the month of May at $632,000 which was a 0.4 percent increase from the May 2018 median sales prices of $629,500.

The condo market had a similar rise in sales volume as 1,160 units were sold last month, which compared to the 1,085 condos sold in May 2018 is a 6.9 percent increase. This is the fourth highest sales volume on record for the month of May and the highest total since 2007. The median sales price of condos in Boston, MA also reached a new record high for the month of May at $592,250 which is a 7.5 percent increase from May 2018’s median sales price of $550,870.

As per the real estate company called Neigborhoodscout.com, the current median house price in Boston is $576,748, which indicates that home prices in Boston are well above the national average for all cities and towns in the United States. One and two bedroom large apartment complexes are the most common housing units in Boston. Other types of housing that are prevalent in Boston include single-family detached homes, duplexes, row houses and homes converted to apartments.

Currently, there are 87 single family homes for sale in Boston, MA on Zillow. Additionally, there are 247 single family homes for rent in Boston, MA. Under potential listings, there are about 10 Foreclosed and 101 Pre-Foreclosure homes. These are the delinquent properties that may be coming to the market soon but are not yet found on a multiple listing service (MLS).

In the past month, 418 homes have been sold in Boston, MA on Redfin.com. Additionally, there were also 1047 condos, 89 townhouses, and 144 multi-family units for sale in Boston last month. The median listing price is around $825,000. According their statistics, the Boston housing market is very competitive. Homes in Boston receive 1 offers on average and sell in around 37 days. The average sale price of a home in Boston was $718K last month, up 5.5% since last year. The average sale price per square foot in Boston is $553, up 0.55% since last year.

Here is the latest Boston housing market data for the month of Jan 2020 from Redfin.com. The sale to list price ratio shows us that it was a trending more like a seller’s real estate market in the past month.

Boston Real Estate Market Trends

Avg. Sale / List

Median List $/Sq Ft

Median Sale Price

Median Sale $/Sq Ft

98.1%

98.1%

$718,000

$553

Analyzing real estate data from multiple sources gives us a much broader perspective of the direction in which a market is moving. There are currently 1064 homes for sale in Boston on Realtor.com. The asking price of single family homes can start from $320,000 and can go up to $25M for a 9000+ square foot magnificent single family residence on the South Slope of Beacon Hill. South Slope is a popular neighborhood with the median price of $2.98M. Beacon Hill has a median listing price of $2.1M, making it the most expensive neighborhood in Boston. Washington Park is the most affordable neighborhood, with a median listing price of $470,000.

According to Realtor.com, 175 homes were newly listed on the market within the last week. There are just 3 new construction single family homes for sale in Boston within a price range of $599,000 to $1.5M. You can find affordable new construction homes in in Southern Mattapan neighborhood. Southern Mattapan neighborhood has low crime risk and a median price of $440,000. Boston is dominated by renter-occupied apartments and roughly 67.18% of Boston’s housing units are rentals. There are currently 3521 rental properties in Boston and their rent prices range from $100 to $40,000 per month. The median rent price in Boston is $2,800.

According to their data, in January 2020, the Boston housing market was a balanced market, which means there was a healthy balance of buyers and sellers in the market. Ideally a buyer would prefer a sale to asking price ratio that’s closer to 90%. Despite Boston being a balanced real estate market, the sellers have managed to hold good leverage in these negotiations in the past month. On an average, they could sell homes for 98.75% of the asking price. A seller would always prefer scenarios which can yield a ratio of 100% or higher.

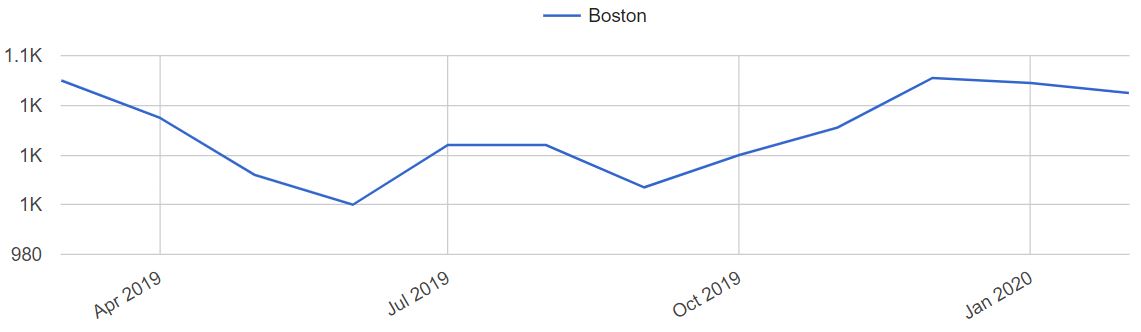

Graph Credits: Realtor.com

In January 2020, the median list price of homes in Boston, MA was $792K, trending up 5.7% year-over-year. The median listing price per square foot was $662. The median sale price was $715,000. On average, homes in Boston, MA sell after 103 days on the market. The trend for median days on market in Boston, MA has gone up since last month, and slightly up since last year. A hot listing in Boston can sell for around list price and go pending in around 19 to 22 days.

In a healthy, balanced market, it would take about six months for the supply to dwindle to zero. In terms of months of supply, the Boston market can tip to favor sellers if the supply drops to below six months of inventory. As per Zillow’s forecast, the prices may rise by 3.6% in the next 12 months. That can happen because when inventory drops, buyers start competing and enter into a bidding wars.

The median list price in Boston is $1,195,000 on Movoto.com. The median list price in Boston went up 4% from January to February. Boston’s home resale inventories is 585, which increased 8 percent since January 2020. The median list price per square foot in Boston is $1,045.

Median Price Per Sq Ft | Movoto.com

As you can see in the graph, the median price per sq ft in Boston rose to its peak value in Dec 2019, when it was $1051. In January 2020 it was $1,049. Distressed properties such as foreclosures and short sales remained the same as a percentage of the total market in February.

Boston is a fairly walkable city in Suffolk County with a population of approximately 616,228 people. If you are looking to invest in the Boston real estate, you should that three most important factors when buying a real estate anywhere are location, location, and location. Location creates desirability. Desirability brings demand. There should be a natural and upcoming high demand for rental properties. Demand would raise the price of your Boston investment real estate and you should be able flip it for a lump sum profit.

The neighborhoods in Boston must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools and shopping malls. Some of the popular neighborhoods in Boston are Cambridge, Medford, East Boston, West Roxbury, Allston, Dedham, South End, Dorchester, Jamaica Plain, Roslindale, South Boston, Charlestown, Braintree, North End and Hyde Park.

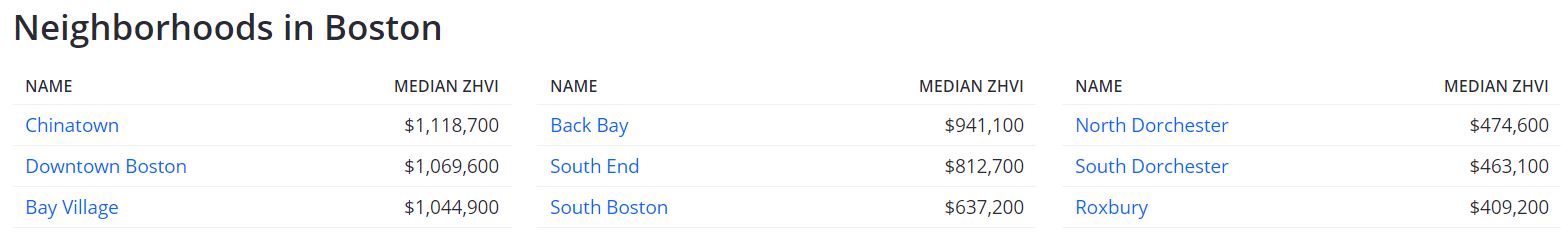

Here is a snapshot that shows the median home values in the some of the popular neighborhoods of Boston.

Courtesy: Zillow

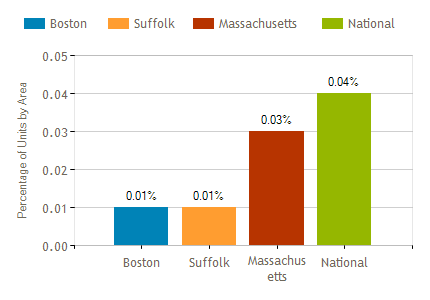

Boston, MA Foreclosures And Bank Owned Homes Statistics 2020

According to Zillow, in Boston 0.4 homes are foreclosed (per 10,000). This is lower than the national value of 1.2. The percent of delinquent mortgages in Boston is 0.8%, which is lower than the national value of 1.1%. With U.S. home values having fallen by more than 20% nationally from their peak in 2007 until their trough in late 2011, many homeowners are now underwater on their mortgages, meaning they owe more than their home is worth. The percent of Boston homeowners underwater on their mortgage is 6.7%, which is higher than Boston-Cambridge-Newton Metro at 3.5%.

Homes for Sale in Boston

Recently Sold

Median List Price

117

1722

$772,000 (12% drop vs Dec 2018)

There are currently 85 properties in Boston, MA that are in some stage of foreclosure (default, auction or bank owned) while the number of homes listed for sale on RealtyTrac is 117. In January 2020, the number of properties that received a foreclosure filing in Boston, MA was 4% higher than the previous month and 56% higher than the same time last year.

In Boston, the zip code with the highest foreclosure rate is 02111, where 1 in every 1926 housing units is foreclosed. 02120 zip code has the lowest foreclosure rate, where 1 in every 5277 housing units becomes delinquent.

Is Boston a Good Place For Real Estate Investment?

Now that you know where Boston is, you probably want to know why we’re recommending it to real estate investors. Investing in real estate is touted as a great way to become wealthy. Is Boston a Good Place For Real Estate Investment?Many real estate investors have asked themselves if buying a property in Boston is good investment? You need to drill deeper into local trends if you want to know what the market holds for the real estate investors and buyers in 2020.

If you are looking to make a profit, you don’t want to buy the most expensive property on the Boston real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, an investment property in Boston that you might move into or sell at retirement in the future. Either way, knowing your profit potential and purpose is the first thing to consider.

Investing in Boston real estate will fetch you good returns in the long term as the home prices in Boston have been trending up year-over-year. Let’s take a look at the number of positive things going on in the Boston real estate market which can help investors who are keen to buy an investment property in this city.

1. Boston is Attractive to Millennials

Millennials are a market real estate agents want to cater to, since they’re buying homes in mass. And Boston is considered one of the cities Millennials love. The challenge for Millennials is affording a market where the median home costs around $740,000. Yet the demand from young and old alike means there’s very little inventory, much less housing stock considered affordable.

2. It Is Attracting Immigrants

Boston isn’t just attracting young people from across the country – it is also attracting immigrations from around the world. The city has seen population growth every year since 2004 in part because of the influx of immigrants attracted to the healthcare, biotech and educational jobs here.

3. The Boston’s Job Market Will Keep People Coming

Boston was ranked the best city in the U.S. for startups. The large number of world class universities provides a large number of skilled workers, many of whom work in medicine, finance and biotech. The constant creation of new jobs will continue to attract residents and help the city retain the ones it already has. The economy is dominated by services, which usually pay high wages and attract more and more job seekers. All these factors have created a hot housing market in Boston, dictated by both home buyers and tenants.

4. Guaranteed Real Estate Appreciation

Strong demand plus limited inventory and limited space to grow will guarantee appreciation of any property you buy in the Boston real estate market. While 2020 will see home prices across the country increase between 2% and 6%, Boston will be at the upper end of that range. This is only a continuation of the steady property increases seen since the 2008 property crash. This is partially due to the fact that the market is so built-up already that land prices are high.

Then there’s the fact it can take a long time to get approval to build up. Boston’s mayor is facing flak for wanting to waive the building height rule just once. Ironically, the Boston shadow law that limits the height of buildings in the Boston housing market has the greatest impact on the downtown areas where people most want to see tall apartment and condo towers built.

5. Downtown Is Hot Market

Millennials and older adults alike are choosing to spend more on an apartment, condo or house to avoid spending hours each week commuting. It is seen as an investment in their quality of life. This explains why downtown Boston is seeing price increases far higher than the rest of the Boston metro area. Condos in downtown Boston at the end of 2018 averaged over $800,000, well above the median sale price in the Boston housing market of $618,000.

Downtown enclaves sell for much more per square foot than properties at the edge of town or in the suburbs; the price hit a thousand dollars a square foot recently. That’s expensive for the U.S. but half the price you’d pay for a comparable apartment in New York City. Ironically, the high price of real estate in NYC explains why many financial firms are expanding in the relatively cheaper city of Boston, home of the mutual fund.

6. Deals Are Becoming Available

The increase in mortgage interest rates is putting pressure on home buyers, limiting what they can afford. This in turn is leading to home builders to cut prices on new properties. According to the Washington Post, Boston home builders are cutting the price of properties on the market by 6%. If you have financing or the cash to invest in the Boston real estate market, you can’t pass up a deal like this.

7. The Huge Educational Market Is an Opportunity

The Boston real estate market and its environs include a whopping hundred universities, colleges and trade schools. There are more than 150,000 college students in Boston and Cambridge alone. You could buy properties across the Boston real estate market and cater to students, and your market is so diverse that you’ll always see demand.

8. Bureaucracy Limits Supply

Boston is an old, East Coast city. We’ve already mentioned the height law and the challenges faced getting anything approved even with the mayor behind it. Unfortunately, Boston’s entrenched bureaucracy limits the redevelopment of large garages and other major projects that could bring thousands of units to the Boston real estate market. If it takes ten years (or more) for the Boston Harbor Garage to be redeveloped, and it is far from the only project on hold, then you can be certain to see high returns on any redevelopment project that creates more housing units within existing buildings. Whether this is converting warehouses into lofts or single family homes into multi-family housing, if you don’t face major roadblocks, you’ll see a great return on the investment.

9. Boston Is Landlord Friendly for the Northeastern U.S.

Boston is landlord friendly compared to markets like NYC. There is no limit on late fees. You don’t have to provide notice before entering the apartment. The state doesn’t require rental licenses to become a landlord. There aren’t laws regarding re-keying or pets. A written rental agreement is only mandatory if your tenant is staying more than 12 months. Evictions are allowed if they are not paying the rent, violating the lease, or breaking the law. You can start evictions two weeks after non-payment of rent. Since evictions can take weeks, screen tenants well for any property in the Boston housing market.

10. You’ll Enjoy High ROI

Rents in the inner Boston Core hit 2800 a month. All those grad students, young single professionals and highly paid power couples are bidding up the limited housing stock available. If you can find a reasonably affordable property in the Boston real estate market and convert it to multiple units or a more upscale clientele, you’ll enjoy significant cash flow from the property. Any future real estate investor in Boston should also have in mind that the expected rental income for both traditional rentals and Airbnb rentals is high.

The combined effect of high property prices and high rental income leads to decent return on investment for Boston rental properties. The taxes here are high compared to the U.S. average but lower than several other states in the area. The income tax rate is much lower than New York, and property taxes are far lower than New Jersey. Therefore, you’ll clear more here than some of the other large Northeast markets.

Luckily for real estate investors in Boston who are interested in Airbnb rentals, they are fully legal in the Boston real estate market and are not even taxed at the moment. Recent discussions among Massachusetts lawmakers failed to result in an agreement on taxes to be charged on short-term rentals.

Investing in Boston Real Estate or Not: The Conclusion

Maybe you have done a bit of real estate investing in Boston, MA but want to take things further and make it into more than a hobby on the side. It’s only wise to think about how you can and should be investing your money. In any property investment, cash flow is gold. Boston is the top market where real estate investments are safe and have high rates of return.The Boston housing market sees steady population growth, faces limited supply, and can’t really go vertical. This means that those who invest in the Boston real estate market will see decent cash flow from nearly any property and guaranteed appreciation. Allston is an excellent neighborhood to buy an investment property in Boston as the median property price is well below the city level. Airbnb rentals are the best option for real estate investing in Boston.

A good cash flow from Boston investment properties means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding a good Boston real estate investment opportunity would be a key to your success. If you invest wisely in the Boston real estate, you could secure your future.

As with any real estate purchase, act wisely. Evaluate the specifics of the Boston housing market at the time you intend to purchase. Hiring a local property management company can help in finding tenants for your investment property in Boston. If it is your first time to invest in Boston real estate, then you would have to be aware of common beginner’s mistakes. Beginners would usually follow the media, buy a property and wait for its value to increase. This could be risky. Real estate investing requires research. We recommend doing your own research or hiring a real estate investment specialist for guidance.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. If housing supply meets housing demand, real estate investors should not miss the opportunity since entry prices of homes remain affordable. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market area, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

The aim of this article was to educate investors who are keen to invest in Boston real estate in 2020. Purchasing an investment property requires a lot of studies, planning, and budgeting. Not all deals are solid investments. We always recommend to do your own research and take help of a real estate investment counselor.

Other Good Markets To Invest in Real Estate in 2020

Apart from the Boston real estate market, you can also invest in Jersey, City. The Jersey City housing market is seeing significant growth because it is close to New York City but isn’t NYC. It has a number of points in its favor, too, like a good job market and local amenities. Renters and buyers alike are taking notice and helping to make Jersey City the fastest growing metropolitan area in the state. Jersey City has been busy redeveloping old neighborhoods, encouraging a mix of new retail, luxury housing and affordable housing.

Jersey City is notable for the major redevelopment on the waterfront, known as the Shore, while properties there enjoy a great view of Manhattan. Jersey City takes things one step further and is setting up a “Friendly Building Program”, where developers build entire buildings where renting through AirBnB is allowed. This is an innovative development in the Jersey City housing market.

Another market that we suggest is the housing market in Pittsburgh, PA. The Pittsburgh real estate market 2020 is seeing an incredible renaissance unlike many other Rust Belt cities. It is attracting new residents, redeveloping its downtown. And it is an excellent place to invest in real estate while it is still in the early stages of its rebound. Huffington Post gave Pittsburgh the seventh slot on the top ten places to be a landlord. They used the average three bedroom rent of $991 a month and median home price of $105,700 to get a gross rental yield of 11.3%.